Special Report: The Contracting Environment in 2024

Highlights of the report:

Download a PDF of these Highlights

Pharmaceutical manufacturer contracting is a key element of account engagement to enhance and/or maintain market access; however, the contracting landscape can vary greatly by therapeutic area. HIRC's report, The Contracting Environment in 2024, assists pharmaceutical manufacturers in understanding trends in contracting with commercial payers across therapeutic categories spanning traditional, specialty and oncology. The report addresses the following questions:

- What is the status of contracts in-place or offered to commercial health plans in the last 12-18 months across 40+ therapeutic areas?

- What is the status of contracts in-place or offered to pharmacy benefit managers in the last 12-18 months across across 15+ broad traditional and specialty categories?

- What contract approaches are most common overall and by therapeutic area (e.g., flat access rebates, price protection, market share rebates)?

- What are the most common average discount/rebate amounts offered across 40+ unique therapeutic areas? What is the status of alternative or novel contracting approaches, such as risk/outcomes-based, portfolio, and indication-based contracts?

Key Finding: The contracting environment in 2024 is active, but varies by therapeutic area with a greater share of contracts reported in more competitive and/or crowded categories; flat access rebates tied to preferred position + price protection are most common.

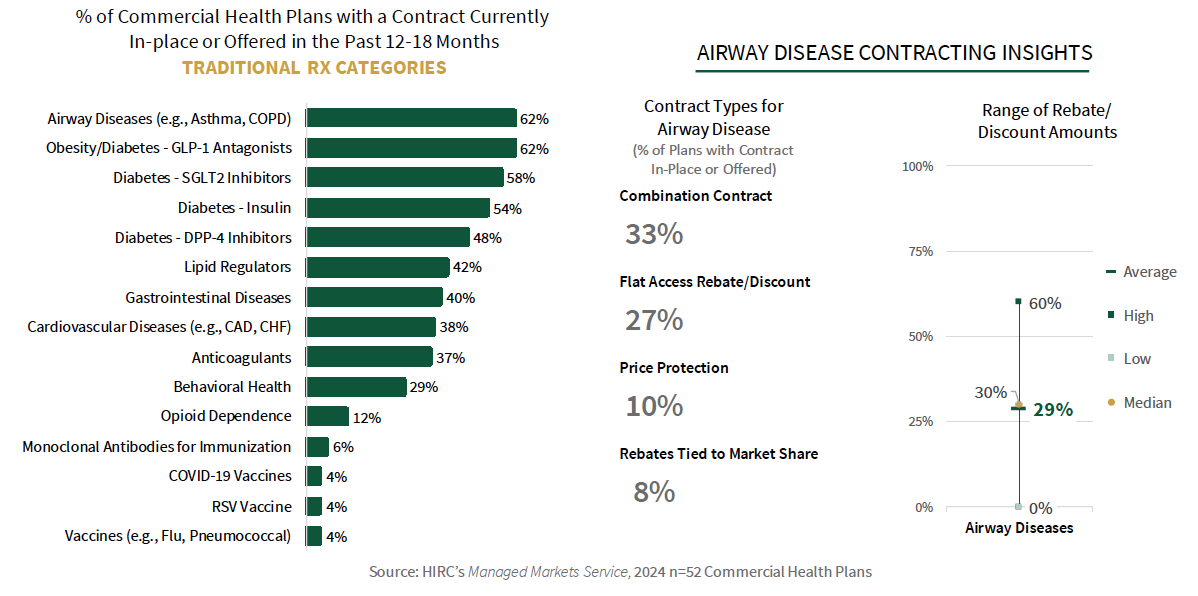

The Contracting Environment: Traditional Rx Categories. Across traditional Rx categories, contracts with commercial health plans are most often reported for airway diseases and GLP-1 antagonists. Just under two-thirds of commercial health plans (62%) have or have been offered a contract in the last 12-18 months for airway disease medications and/or GLP-1 antagonists. In airway diseases, a 'combination contract' approach that includes both a flat access rebate and price protection is most common. Average discount amounts are reported at around 29%.

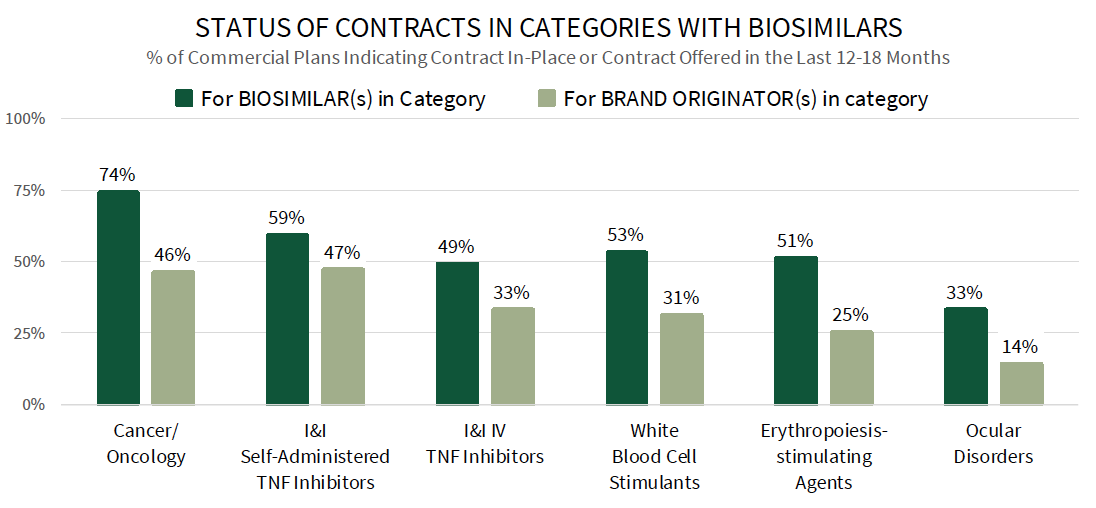

A Greater Share of Commercial Plans Report Contracts for Biosimilars than Reference Brands. When it comes to categories with biosimilars, commercial health plans more often report contracts in-place or offered for the biosimilar(s) in the category compared to reference brands. For example, 74% of plans report a contract in-place or offered for oncology biosimilars, compared to 46% reporting contracts for brands. The complete report examines the contracting environment across numerous specialty and oncology therapeutic areas/drug classes.

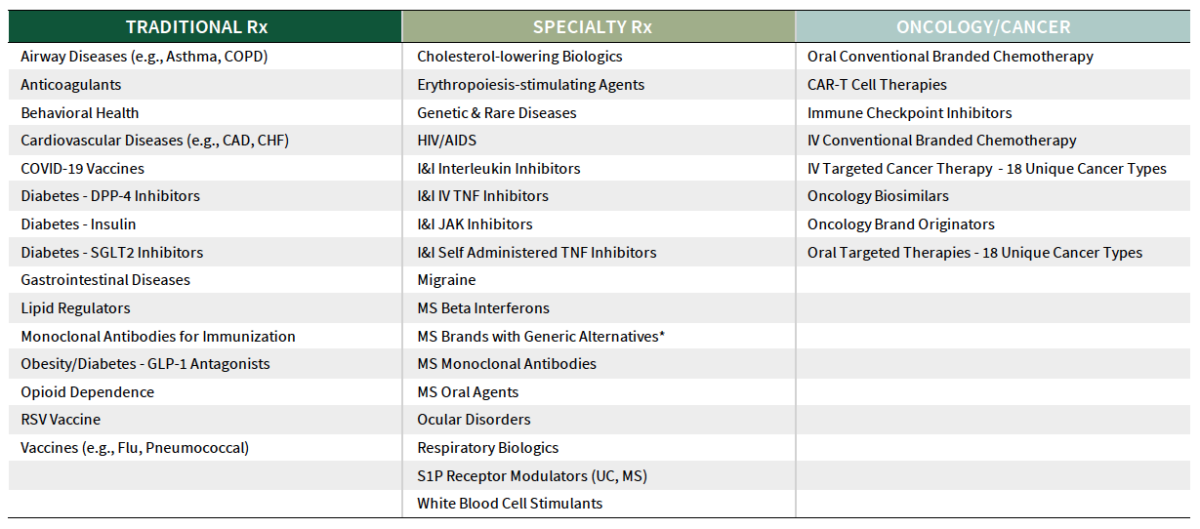

Extensive Listing of Therapeutic Areas are Examined. The complete report reviews contracting prevalence, approaches/types, and most common average rebate discount amounts across the following therapeutic areas/classes:

Research Methodology and Report Availability. Special reports draw upon data across HIRC services, allowing readers to glean insights into high level topics across varying market segments, channels, and/or therapeutic areas. HIRC's report, The Contracting Environment in 2024, includes survey and qualitative follow-up interview insights from various commercial health plan and pharmacy benefit manager panels, collected in 2024. The report is available now to HIRC’s Special Report Series subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >