Medicare Advantage Plans: Market Landscape Trends, Contracting Environment and Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

The Medicare Advantage market is undergoing complex transformation as plans prepare for the implementation of the Inflation Reduction Act (IRA). HIRC's report, Medicare Advantage Plans: Market Landscape Trends, Contracting Environment and Manufacturer Engagement, reviews the current market landscape, Medicare Advantage plan executives' strategic imperatives, and anticipated responses to the IRA, and focuses on trends in contracting. The report addresses the following questions:

- What is the current landscape of the Medicare Advantage market, and which plans account for the majority of market share?

- What are Medicare Advantage plans' most important strategic imperatives for 2024 and what are the most disruptive market trends? How might the IRA impact Medicare Advantage plans' utilization management, formulary, and contracting strategies?

- Which manufacturers are most often nominated as Medicare Advantage plans' overall "Partner of Choice"? How do manufacturers benchmark across willingness to contract and overall quality of programs/resources?

- What is the current contracting environment across 20+ therapeutic areas? Which contract types are most frequently offered and what are the most common rebate/discount amounts?

Key Finding: Medicare Advantage plans expect to ramp up management in therapeutic areas with high cost and utilization to balance the financial impact of the Inflation Reduction Act.

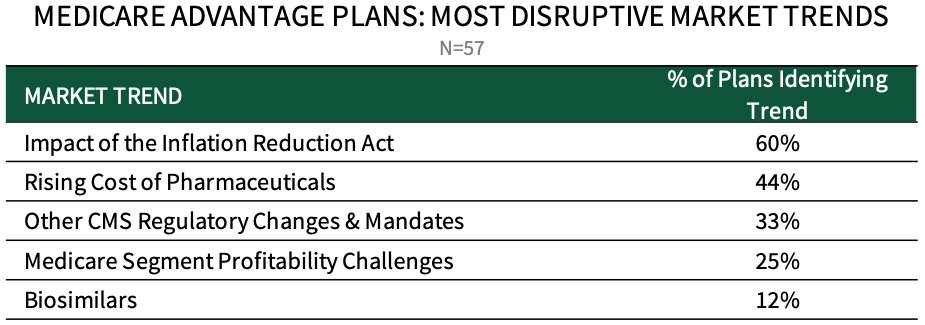

Impact of IRA, Rising Cost of Pharmaceuticals Identified as MA Plans' Top Market Trends in 2024. Medicare Advantage key decision-makers report a number of market trends with potential to impact their organizations in 2024. The top trends identified are (1) impact of the Inflation Reduction Act, (2) rising cost of pharmaceuticals, and (3) other CMS regulatory changes and mandates.

The full report provides a complete listing of MA plans' top market trends and strategic imperatives in 2024.

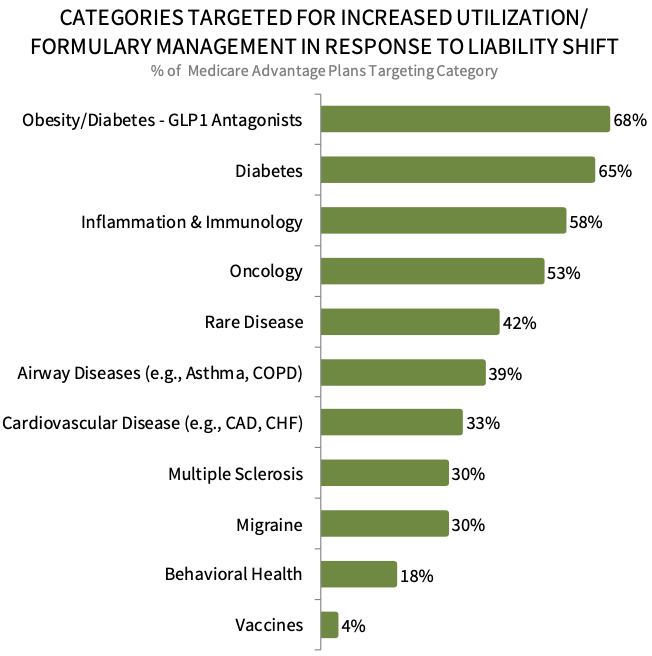

GLP-1 Antagonists and Diabetes Targeted Most for Greater Management in Response to the IRA. In response to the shift of plan liability during the catastrophic phase, greater utilization and formulary management are expected. About 68% of MA plans report targeting obesity/weight loss medications for greater utilization/formulary management, followed by 65% targeting diabetes drugs, and 58% targeting I&I medications. Roughly half of plans are targeting high-cost oncology and rare disease drugs for greater management as well. Plans' expected utilization management tactics for each therapeutic area are examined in the full report.

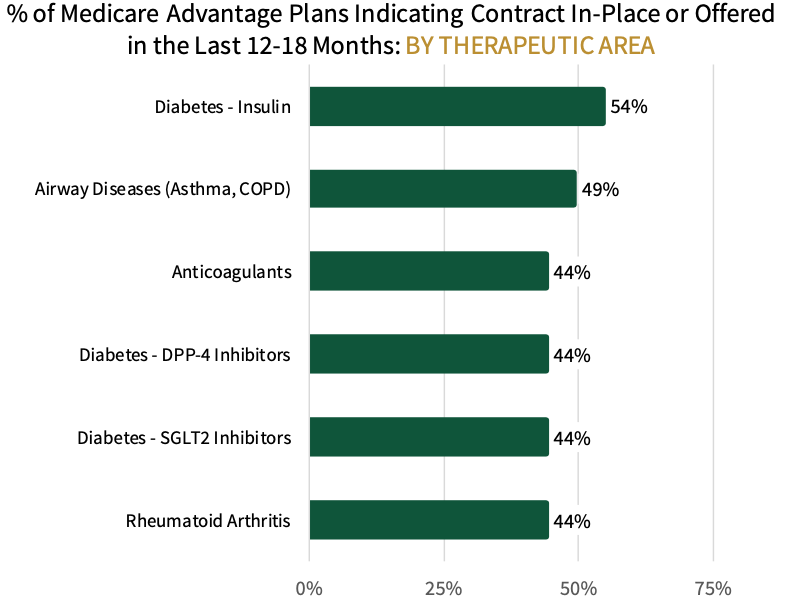

The Contracting Environment for Medicare Advantage. Panelists were asked to consider a list of 20+ therapeutic areas and indicate if their plan has a contract in-place or has been offered a contract in the past 12-18 months. Medicare Advantage respondents most frequently report contracts for diabetes - insulin products (54% of plans), followed by airway disease medications (49%). The full report provides a complete listing of contracting activity as well as rebate/discount amounts across 20+ therapeutic areas.

Research Methodology and Report Availability. In July 2024, HIRC surveyed 57 Medicare Advantage plan pharmacy and medical directors from national, regional, and BCBS plans. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Medicare Advantage Plans: Market Landscape Trends, Contracting Environment and Manufacturer Engagement, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >