Pharmacy Benefit Managers: Oncology Medication Distribution, Formularies and Contracting

Highlights of the report:

Download a PDF of these Highlights

Pharmacy benefit managers (PBMs) are actively focusing on contracting and formulary control to manage cost and utilization of oncology medications in 2024. HIRC's report, Pharmacy Benefit Managers: Oncology Medication Distribution, Formularies, and Contracting, examines PBMs' oncology medication management approaches and the resulting contracting environment across oncology therapeutic areas. The report addresses the following questions:

- What are the recent trends and level of PBM involvement in oncology drug dispensing and distribution?

- Which oncology medication management tactics are utilized by PBMs?

- What is the status of and future expectations for oncology formularies and excluded product lists?

- What is the perceived contracting environment across oncology medication types?

- What is the estimated level of rebates firms offer to compete for formulary access?

- Which manufacturers are most often nominated as PBMs' Partner of Choice? Which are the most willing to contract?

Key Finding: Over the next 12-18 months, PBMs are looking to increase use of formulary exclusions, oncology preferred drug lists, and step therapy to better manage oncology drug costs for commercial and Medicare clients.

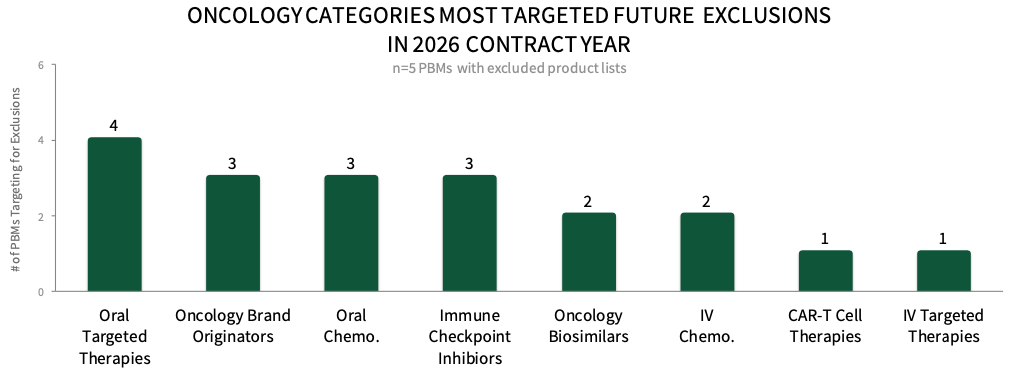

PBMs are Targeting Oral Targeted Therapies for Additional Exclusions in 2026. Respondents were asked which oncology medication categories will be most targeted for future exclusions in the 2026 contract year. Panelists suggest that oral targeted therapies will most often be targeted for future exclusions, followed by oncology brand originators, oral conventional chemotherapy medications, and immune checkpoint inhibitors. The full report provides additional insights on PBM contracting expectations to avoid exclusion, as well as the factors driving formulary decision-making.

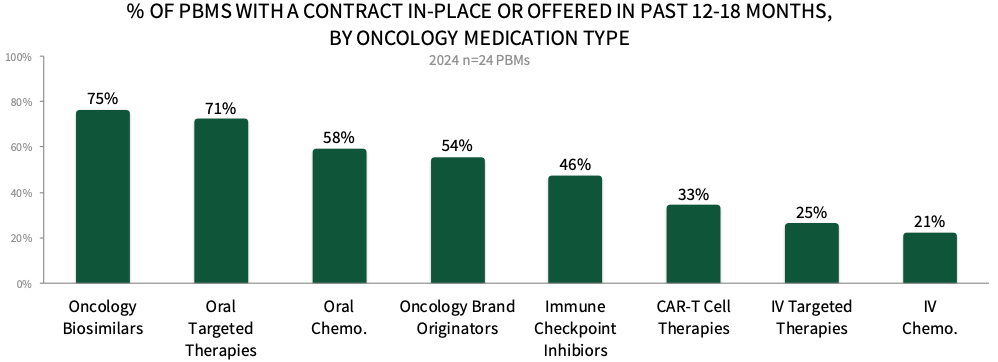

Contracting Environment for Oncology Medications. About 75% of PBM respondents in HIRC's sample report their organization currently has contract(s) in-place or has been offered a contract for oncology biosimilars and oral targeted therapies. Additionally, over 50% of PBMs have a contract in-place or have been offered a contract for oral targeted therapies (71%), oral conventional chemotherapy medications (58%), and oncology brand originators (54%). The full report examines contract approaches/types and most common discount/rebate amounts in each oncology category and across 18 unique cancer types.

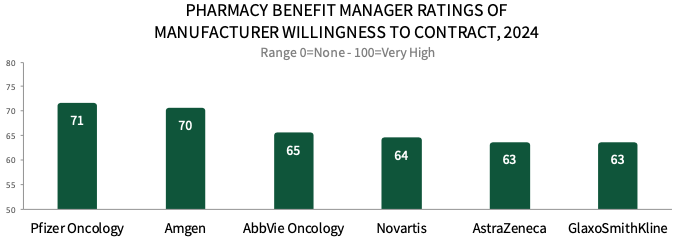

PBM Executives Rate Pfizer Oncology and Amgen As Most Willing to Contract in Oncology. Respondents were asked to consider a list of oncology medication manufacturers and rate their overall willingness to contract on a scale of 0=none to 100=very high. Pfizer Oncology leads with the highest willingness to contract rating, followed closely by Amgen, AbbVie Oncology, Novartis, AstraZeneca, and GlaxoSmithKline. The full report provides a complete list of PBM executives' ratings across a list of 40+ manufacturers, as well as nominations for partner of choice and best program/resource support in oncology.

Research Methodology and Report Availability. In September 2024, HIRC surveyed 24 pharmacy benefit manager key decision-makers. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Pharmacy Benefit Managers: Oncology Medication Distribution, Formularies and Contracting, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >