Medicare Advantage Plans: Specialty Rx Mgt., Contracting, and Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

Medicare Advantage (MA) plans are expected to manage specialty pharmaceuticals more aggressively, especially as we move towards full implementation of the IRA. HIRC’s report, Medicare Advantage Plans: Specialty Medication Management, Contracting, and Best-in-Class Manufacturer Engagement, examines plan responses to key provisions in the IRA, the current UM tactics impacting seniors taking specialty drugs, as well as trends in contracting and best-in-class specialty portfolio support. The report addresses the following:

- How are MA plans responding to the Inflation Reduction Act's (IRA) Part D benefit design changes and negotiated drug prices? What impact could these changes have on the specialty medication management and contracting landscape?

- What are MA plans' top activities to better manage the cost and utilization of specialty medications in 2024/2025?

- What is the current status of key formulary & utilization management tactics across 15 top specialty therapeutic areas?

- What is the nature of the contracting environment for specialty medications in Medicare Advantage?

- Which manufacturers stand out as best in Medicare Advantage plan engagement to support their specialty portfolios?

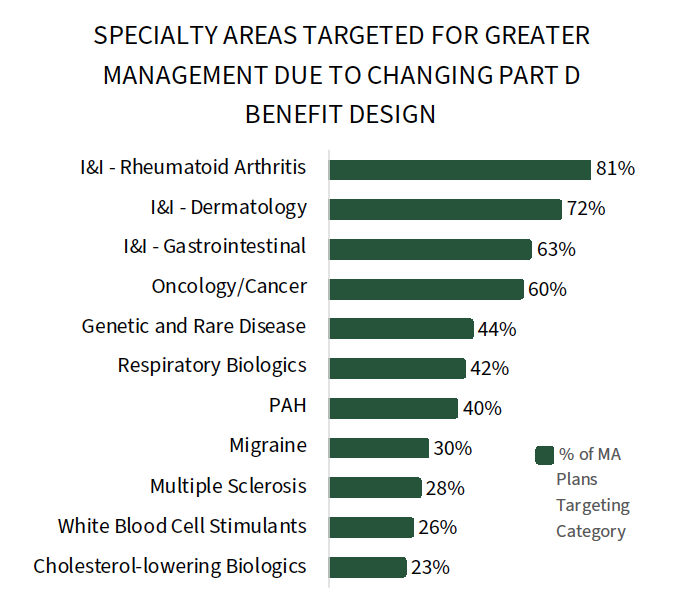

Key Finding: Looking ahead to 2025/2026, expect Medicare Advantage plans to target crowded and competitive specialty categories for greater utilization management and offer narrower formularies where possible.

MA Plans Report Targeting I&I for Tighter Management. In response to the shift of plan liability during the catastrophic phase in Medicare Part D, Medicare Advantage plans indicate they are most targeting inflammation & immunology for greater management; 81% of plans report targeting rheumatoid arthritis drugs specifically. Plans are looking to leverage self-injectable biosimilars to better manage their costs, though we may not see a significant shift away from HUMIRA until 2026 or later. Another 60% of plans are targeting oncology drugs (within what is allowed for protected class management).

The full report examines the specific UM tactics plans intend to apply to each therapeutic area.

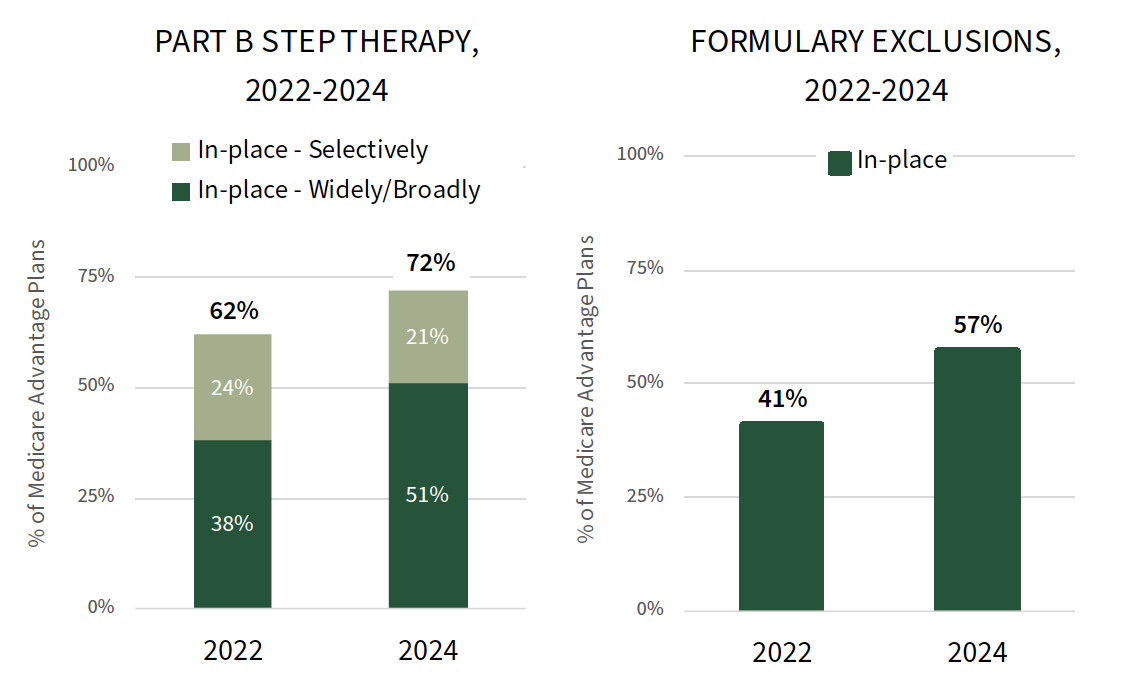

Medicare Advantage Plans Broaden Use of Part B Step Therapy and Formulary Exclusions. Outside of protected classes, Medicare Advantage plans have a variety of tools at their disposal to manage drug cost & utilization. In 2024, plans report broader use of both Part B step therapy and formulary exclusions.

- Nearly three-quarters of MA plans (72%) of plans have implemented Part B step therapy in 2024, up from 62% in 2022. And, the percent of plans implementing Part B step therapy widely/broadly (3+ therapeutic areas) has increased notably over 2 years, from 38% to 51%.

- The percentage of MA plans with formulary exclusions for specialty increased to 57% of plans in 2024, up from 41% in 2022, a notable departure from past trend in Medicare.

The full report examines MA plans' specialty drug management activities in detail.

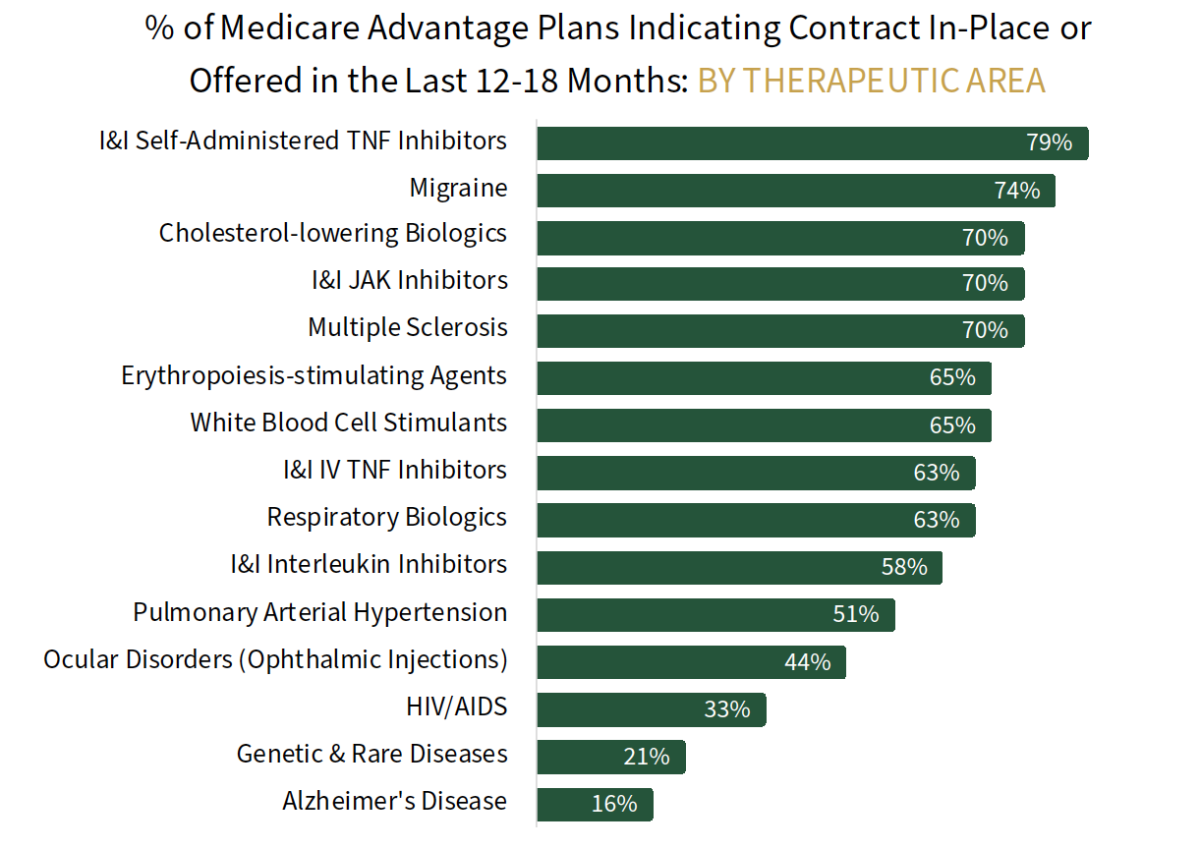

The Contracting Environment for Specialty Medications in Medicare Advantage is Active. Medicare Advantage plan leaders report a relatively competitive contracting environment for specialty medications, depending on the therapeutic class. More contracting is observed in crowded classes, or classes with biosimilars competition, whereas far less contracting is observed in rare diseases & Alzheimer's. The first year of negotiated Maximum Fair Prices (MFP) targeted select products in I&I and oncology. These negotiated prices could enhance payers’ contracting leverage for competiting products in those classes.

The full report examines most common contract types and rebate/discount amounts across 15 specialty categories.

Research Methodology and Report Availability. In July/August HIRC surveyed 43 pharmacy and medical directors from national, regional, and BCBS Medicare Advantage plans representing 22.2 million lives. Online surveys and follow-up telephone interviews were used to gather information. The Medicare Advantage Plans: Specialty Medication Management, Contracting, and Best-in-Class Manufacturer Engagement report is part of the Specialty Pharmaceuticals Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >