Integrated Delivery Networks: Market Landscape and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

Integrated Delivery Networks: Market Landscape and Strategic Imperatives Integrated Delivery Networks (IDNs) report a number of market challenges impacting their businesses in 2024. HIRC's report, Integrated Delivery Networks: Market Landscape and Strategic Imperatives, provides a market overview of IDNs/systems, including recent market activity, the status of value-based reimbursement, and IDNs' most urgent strategic imperatives for 2024. The following questions are addressed:

- What is the latest news and market activity in the IDN/health system segment?

- Which key market trends are driving IDN decision-making and overall strategy?

- What are IDN decision-makers' most urgent strategic imperatives to address as they adjust to a complex and dynamic market landscape?

- What is the status of IDN/systems' risk-bearing activities, such as health system-owned health plans, direct-to-employer contracts, insurer joint ventures, and participation in government and commercial value-based payment model programs?

- How are IDNs enhancing access to care across the continuum?

- What is the scope of IDNs' pharmacy services? What is the status of IDN/health system-owned specialty pharmacies?

Key Finding: Declining reimbursement, workforce challenges, and continued 340B developments are among the drivers of IDNs' cost containment and growth strategies in 2024.

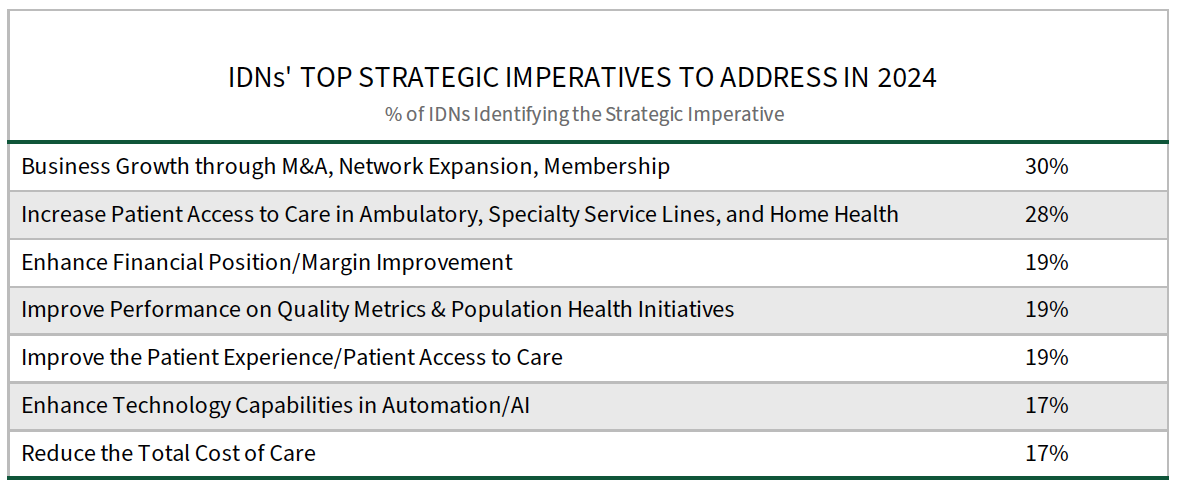

A Number of Market Dynamics Have IDNs Laser Focused on Growth and Margin Improvement. IDNs are grappling with a number of financially impactful market trends in 2024 and are responding with many activities aimed at cost containment and revenue growth. IDNs’ top strategic imperatives in 2024 include 1) Pursue business growth through M&A and network/membership expansion, 2) Increase access to ambulatory care. These are followed by three additional strategic priorities: Enhance financial position/margin improvement, improve quality metric performance/population health, and improve the patient experience.

The full report provides the complete listing of most impactful market trends and IDNs' strategic imperatives for 2024.

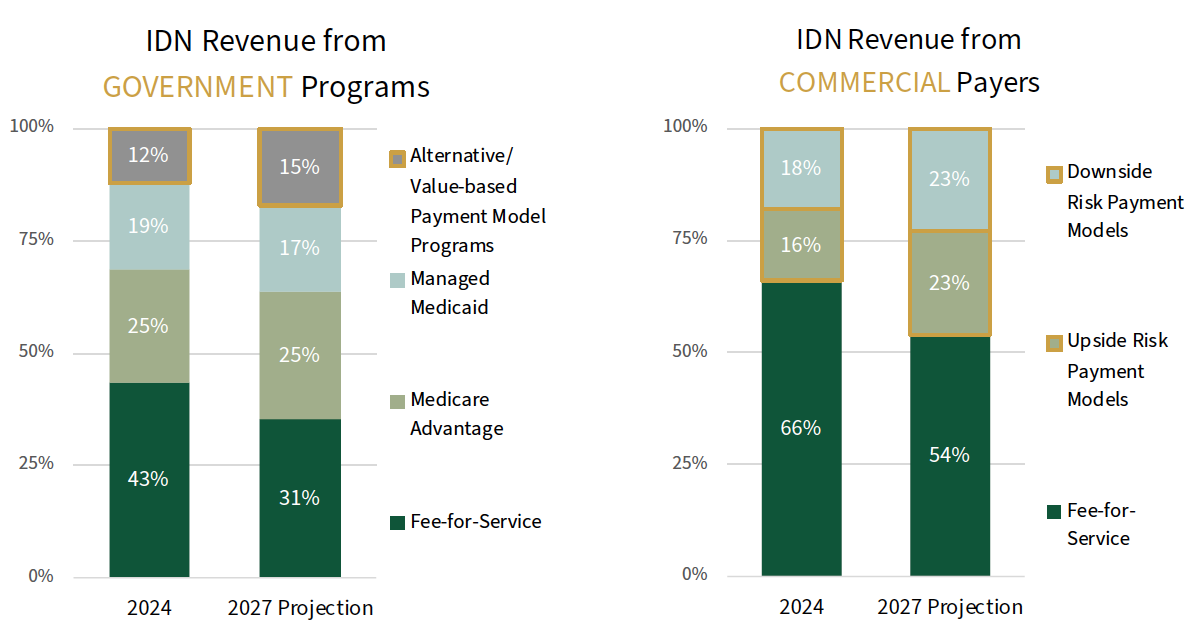

IDN Leaders Predict Growth in Reimbursement Tied to Value. Government and commercial payers have offered alternative payment model programs to providers for quite some time, shifting the landscape of payments from fee-for-service models towards more risk-based payment models. IDN decision-makers project that 15% of payments from government payers could be tied to value by 2027, and 46% of revenue from commercial payers could be tied to value by 2027.

The full report examines IDN participation in government & commercial payer APMs, as well as the status of several IDN risk-bearing activities, such as health system-led health plans, direct-to-employer agreements, and insurer + provider joint ventures.

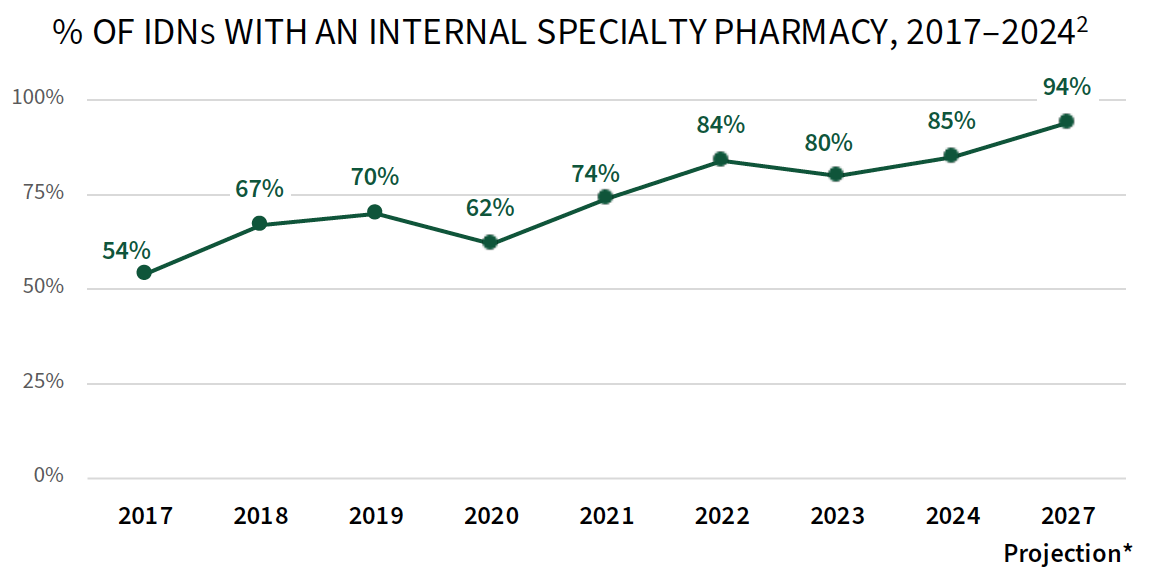

IDNs Continue to Push into Specialty Pharmacy. The percentage of IDNs with a system-owned specialty pharmacy offering has quickly grown from 54% of IDNs in 2017 to 85% in 2024. Another 9% are projected to add specialty pharmacy capabilities by the year 2027. HIRC estimates there to be over 450 accredited provider-led specialty pharmacy organizations operating in the U.S. In addition to pharmacy services, the complete report examines the status of other services across the care continuum (e.g., urgent care, telehealth, virtual hospital, home care).

Research Methodology and Report Availability. In December and January, HIRC surveyed 54 IDN senior leaders and pharmacy and medical directors. In-depth secondary research, online surveys, and follow-up telephone interviews were used to gather information. The full report, Integrated Delivery Networks: Market Landscape and Strategic Imperatives, is part of the Organized Providers Service, and is now available to subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >