Medicare Advantage Plans: Oncology Medication Management, Contracting, and Manufacturer Engagement

Highlights of the report:

Download a PDF of these Highlights

Medicare Advantage plans are taking proactive steps to tighten oncology medication management activities and increase contracting with manufacturers in anticipation of the complete implementation of the Inflation Reduction Act (IRA). HIRC's report, Medicare Advantage Plans: Oncology Medication Management, Contracting, and Manufacturer Engagement, examines current management approaches, the contracting environment, and best-in-class manufacturer support in oncology. The report addresses the following questions:

- How are MA plans responding to the Inflation Reduction Act's (IRA) Part D benefit design changes and negotiated drug prices? What impact could these changes have on the oncology medication management and contracting landscape?

- What is the status of payers' utilization management tactics across oncology medication types (e.g., targeted therapies, checkpoint inhibitors, biosimilars, CAR-T)?

- What is the status of oncology preferred drug lists (PDL) and clinical pathway adoption across cancer types?

- How are plans managing oncology medication distribution (e.g., preferred specialty pharmacy, white bagging, site of care management)?

Key Finding: To better manage the cost and utilization of oncology medications, Medicare Advantage respondents expect to (1) expand use of PAs, (2) select additional preferred products, and (3) improve alignment and/or risk sharing with oncology providers.

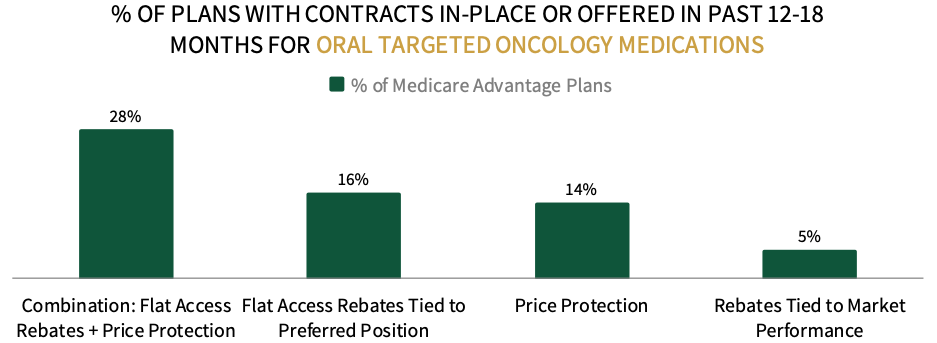

Contracting Environment for Oral Targeted Cancer Therapies. When asked about the contracting environment for oral targeted therapies, Medicare respondents indicate that combination contracts involving flat access rebates and price protection are most common. The full report examines contracting approaches and most common discount amounts offered across oncology biosimilars and brand originators, oral and IV targeted therapies, CAR-T therapies, and immune checkpoint inhibitors.

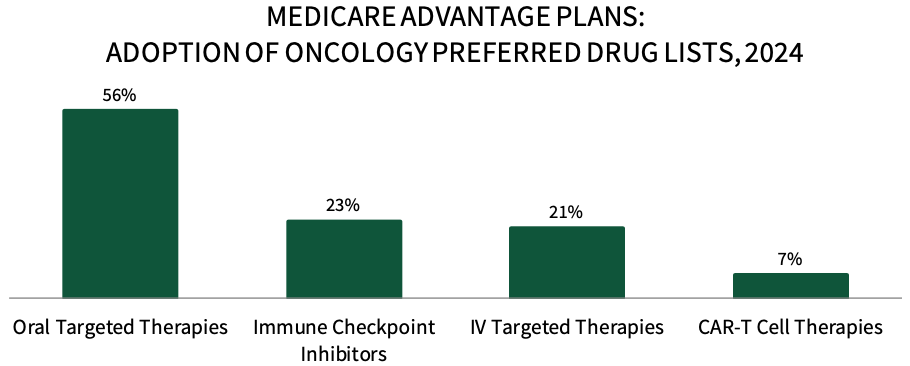

Medicare Advantage Plans are Actively Preferring Oncology Medications in 2024. About 56% of respondents in HIRC's sample report that their plan has preferred oral targeted therapies for their Medicare Advantage population in 2024, followed by 23% with preferred immune checkpoint inhibitors, 21% with preferred IV targeted therapies, and 7% with preferred CAR-T cell therapies. The full report examines the status of preferred products across 18 cancer types, as well as uptake across oncology biosimilars, and the utilization management tactics used to promote the use of plans' preferred products.

Pfizer Oncology Leads as Most Supportive Oncology Manufacturer for Medicare Advantage Plans. Medicare Advantage plan decision-makers were asked to nominate a manufacturer in three key areas: 1) Overall Partner of Choice in Oncology, 2) Best-in-Class Programs/Resources, and 3) Most Willing to Contract for medications covered under Medicare Part D and Part B. Pfizer Oncology, Merck Oncology, and AbbVie Oncology are consistently among the leaders nominated in best-in-class across categories.

Research Methodology and Report Availability. In August HIRC surveyed 43 pharmacy and medical directors from national, regional, and BCBS plans representing 22.2 million MA lives. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Medicare Advantage Plans: Oncology Medication Management, Contracting, and Manufacturer Engagement, is available now to HIRC’s Managed Oncology subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >