Medicare Advantage Plans: Market Landscape and Strategic Imperatives

Highlights of the report:

Download a PDF of these Highlights

As changing government regulations create cost concerns for Medicare Advantage plans, payers focus on value and accountability and are aggressively hunting cost-savings via alternative payment models, quality, and outcomes. HIRC's report, Medicare Advantage Plans: Market Landscape and Strategic Imperatives, reviews the current market landscape, Medicare Advantage plan executives' strategic imperatives, and examines views on market trends that could further affect the segment. The report addresses the following questions:

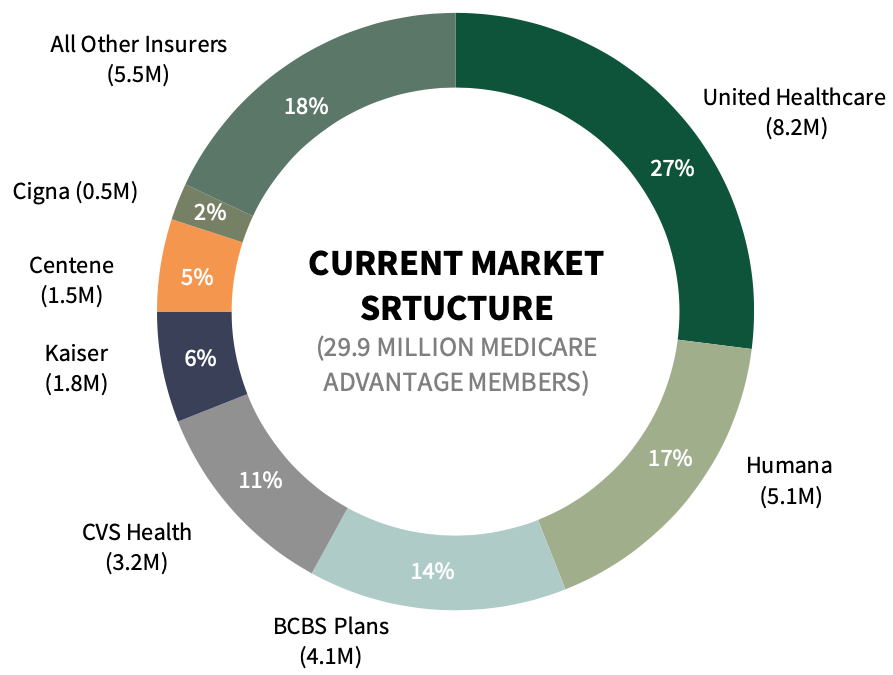

- What is the current landscape of the Medicare Advantage market, and which plans currently account for the majority of market share?

- What are Medicare Advantage plans' most important strategic imperatives for 2022?

- What do Medicare Advantage panelists identify as the most notable market trends impacting their business? Which CMS policy mandates are most concerning?

- Which therapeutic areas are most often targeted for quality metric adoption?

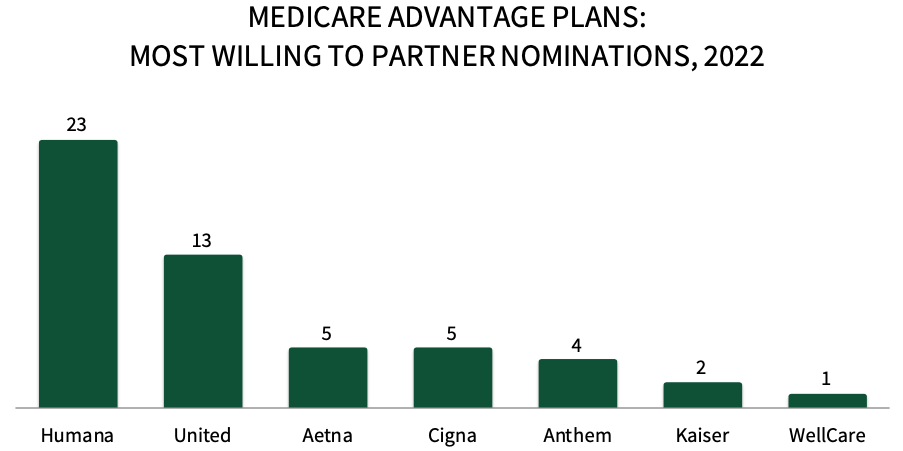

- Which plans are viewed as having the strongest ability to limit brand access? Which are viewed as most willing to partner with manufacturers?

Key Finding: Customer retention and growth is identified as Medicare Advantage plans' top strategic imperative in 2022, followed by improving Star ratings and moderating specialty drug spend.

Top Market Trends Affecting Medicare Advantage Plans. Medicare Advantage key decision-makers were asked to provide the top three market trends with the greatest potential to impact the Medicare Advantage space. Panelists identify government regulations, such as the Inflation Reduction Act, as well as rising pharmaceutical spend, and increased emphasis on quality metrics and population health as most impactful trends in 2022.

The full report includes a detailed examination of top market trends and dynamics most concerning to Medicare Advantage executives.

Three Health Insurance Companies Account for Over 55% of Total Medicare Advantage Lives. The Medicare Advantage market continues to grow with insurance companies providing medical coverage for approximately 29.9 million enrollees in 2022. Three public managed care organizations (United Healthcare, Humana, and CVS Health) together account for over 55% of Medicare Advantage lives.

Humana Nominated as Most Willing to Partner in the Medicare Advantage Segment. HIRC queried managed markets professionals from leading pharmaceutical firms to determine which Medicare Advantage plans have the strongest ability to limit brand access and which are most willing to partner with manufacturers. Respondents nominate Humana as the most willing to partner in the Medicare Advantage segment, followed by United Healthcare, Aetna, and Cigna.

Research Methodology and Report Availability. In August 2022, HIRC surveyed 48 Medicare Advantage plan pharmacy and medical directors from national, regional, and BCBS plans. Online surveys and follow-up telephone interviews were used to gather information. The complete report, Medicare Advantage Plans: Market Landscape and Strategic Imperatives, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >