Market Access and Partnership Landscape: Key Pharmacy Benefit Manager Accounts

Highlights of the report:

Download a PDF of these Highlights

Vertical integration between Plans, PBMs, GPOs, Specialty Pharmacies, and Providers continues to challenge pharmaceutical manufacturer access and partnership opportunities. An understanding of the access and partnership landscape for key accounts is critical for effective account planning and strategy development. HIRC's report, Market Access and Partnership Landscape, provides manufacturer ratings of select customers' ability to limit brand access and willingness to partner. The report addresses the following questions:

- Which Pharmacy Benefit Manager & GPO accounts are rated by manufacturers as most able to limit brand access? Why?

- Which Pharmacy Benefit Manager & GPO accounts are rated by manufacturers as most willing to partner? Why?

- What are the key characteristics of Pharmacy Benefit Managers with a strong ability to limit brand access?

- What are the key characteristics of Pharmacy Benefit Managers that are the most willing to partner?

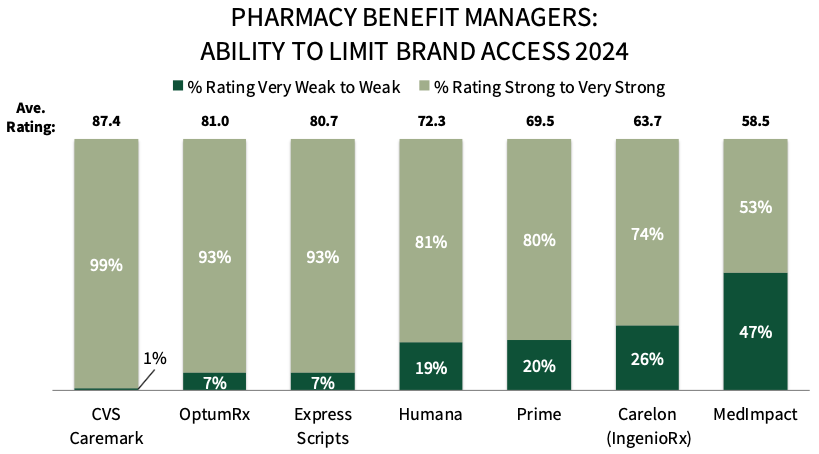

Key Finding: Companies with the strongest ability to limit brand access are typically characterized by their size and ability to impact market share, UM & formulary control, and expanded use of excluded or preferred drug lists.

CVS Caremark Leads with Highest Ability to Limit Brand Access in the PBM Segment. Managed markets respondents from leading pharmaceutical firms rate CVS Caremark highest in ability to limit brand access in the Pharmacy Benefit Manager segment, with panelists noting their patient volume and market footprint, contracting power, and strong formulary control & utilization management strategies. CVS is followed by OptumRx and Express Scripts.

Panelists Identify the Inflation Reduction Act & Vertical Integration/Consolidation as Top Market Trends in 2024. Managed markets respondents from leading pharmaceutical firms were asked to list the top market trends/disruptors with the highest potential to limit access to customers. Respondents identify the Inflation Reduction Act followed by vertical integration & consolidation as the top market trends for the second year in a row. Secondary trends include expanded use of copay accumulators and/or copay maximizers, launch of biosimilars, and expanded use of excluded or preferred drug lists. The full report includes a complete listing of pharmaceutical firms' most disruptive market trends in 2024.

The full report, Market Access and Partnership Landscape, provides manufacturer ratings of customers' ability to limit brand access and willingness to partner, as well as the factors driving ratings across the following key channels:

- Pharmacy Benefit Managers

- PBM-Owned Group Purchasing Organizations

- Commercial Health Plans

- Medicare Advantage Plans

- Medicaid MCOs

Research Methodology and Report Availability. In January, HIRC surveyed 86 respondents at 38 pharmaceutical firms. Online surveys were used to gather quantitative and qualitative information. The complete report, Market Access and Partnership Landscape, is available now to HIRC’s Managed Markets subscribers at www.hirc.com.

Download a PDF of these Highlights

Download Full Report (Subscribers only) >